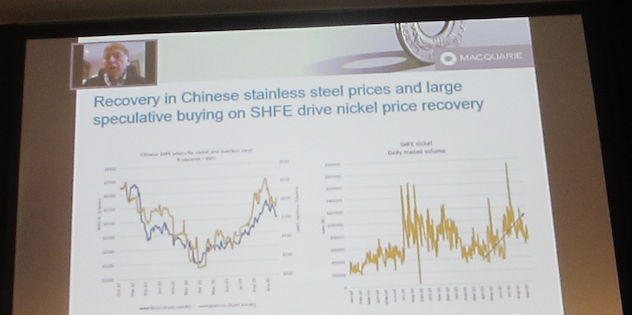

A world nickel industry guru identified the Sconi nickel laterite project in Queensland as one of the potential major new mines in the world to service the growing battery market for electric vehicles. The Sconi deposit is located near Greenvale west of Townsville. Jim Lennon of Macquarie Commodities (Europe) listed Sconi in his keynote and […]

Thank-you for your interest in iQ Industry Queensland. We invite you to purchase a registration through iQ Industry Queensland to get the most out of the service.